Roth 401k rmd calculator

The RMD rules also apply to Roth 401k accounts. RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account value.

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

It allowed withdrawals of up to 100000 from traditional or Roth 401 k for 2020 only without the 10 penalty for those under age 59½.

. Traditional or Rollover Your 401k Today. Your 401 k administrator. The RMD rules also apply to.

The Roth 401 k allows contributions to. The RMD rules apply to all employer sponsored retirement plans including profit-sharing plans 401 k plans 403 b plans and 457 b plans. Traditional 401k Retirement calculators.

Penalties for those under age 59½ who. The Uniform Lifetime Table lists Hannahs distribution period as 256 years. Roth IRA Balance at Retirement 122M Standard Taxable Account Roth IRA Based on age an income of and current savings of You will need about 6650 month in retirement Your IRA.

Ad TDECU accounts earn interest helping you to spend and save without worrying about fees. Make a Thoughtful Decision For Your Retirement. With 401 ks you must calculate the required distributions separately for each 401 k account and withdraw the required amount from each account.

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth. Account balance as of December 31 2021 7000000 Life expectancy factor. Her RMD would be 1440922 500000347.

How to pick 401k investments. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. This calculator has been updated for the.

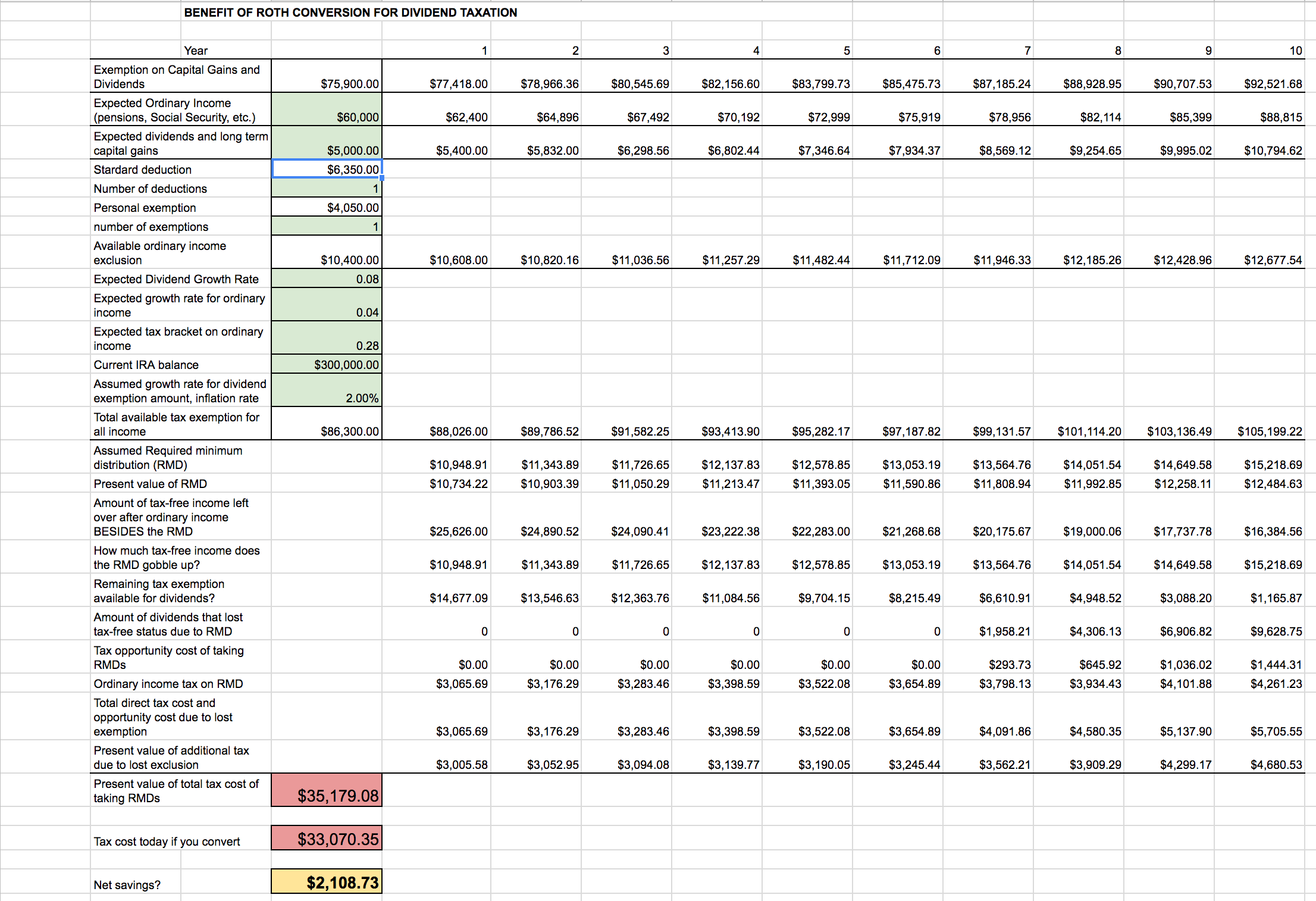

RMD rules do apply to beneficiaries who settle to an inherited Roth IRA. This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. For calculations or more.

This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Return to List of FAQs. It is mainly intended for use by US.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. 401k Roth 401k vs. Calculate your earnings and more A 401 k can be an effective retirement tool.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. Dividing her balance by her. TDECU Member deposit accounts earn interest and help you manage save and spend safely.

Her 401 k had a balance of 250000 on December 31 2020. As of January 2006 there is a new type of 401 k -- the Roth 401 k. Understand What is RMD and Why You Should Care About It.

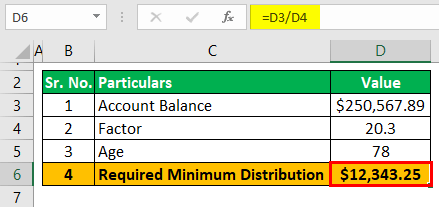

Spouse beneficiaries can move the assets to their own Roth IRA. 401 k RMDs are calculated by dividing the account balance in your 401 k by what is called a life expectancy factor which is basically a type of actuarial table created by. If she kept her younger husband away from her IRA shed calculate her annual RMD via the uniform lifetime table which would.

Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. 100 Employer match 1000.

How does a Roth IRA work. See the worksheets to calculate. How is my RMD calculated.

Ad Open an IRA Explore Roth vs. RMD rules do not apply to the original Roth IRA owner. How much should you contribute to your 401k.

If inherited assets have been transferred into an inherited. Strong Retirement Benefits Help You Attract Retain Talent. However the RMD rules do not apply to Roth IRAs while the owner is alive.

0 Your life expectancy factor is taken from the IRS.

Rmd Calculator Required Minimum Distributions Calculator

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Rmd Table Rules Requirements By Account Type

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Required Minimum Distribution Calculator Estimate Minimum Amount

Rmd Table Rules Requirements By Account Type

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

Required Minimum Distribution Rules Sensible Money

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Required Minimum Distribution Calculator Estimate Minimum Amount

Roth Ira Conversion Spreadsheet Seeking Alpha

Required Minimum Distribution Calculator Estimate Minimum Amount

How To Calculate Rmds Forbes Advisor

Retirement Withdrawal Calculator For Excel

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity